We’re settled in return for keeping backed products and functions, otherwise by you clicking on particular website links printed for the our web site. While we strive to offer many also offers, Bankrate does not include information regarding all financial otherwise borrowing device otherwise provider. During the Santander Financial, for example, there’s an everyday mobile put restriction of $dos,500 to own people who’ve had an account for at the least 3 months. Chase caters to thousands of people having a general range of products. Pursue on the web lets you manage your Pursue accounts, consider statements, display interest, pay bills or transfer financing properly from central put. For questions otherwise issues, excite contact Chase customer service otherwise write to us in the Chase problems and you may views.

Find the appropriate Family savings | cleopatra 2 $1 deposit

- Mobile deposit is amongst the ways in which financial is definitely growing.

- Twice presentment is when an identical cheque are transferred double.

- The brand new deals try canned during your mobile phone seller, and this usually has powerful security measures in place.

- Cellular and you can local casino gambling will likely be a great way to victory specific brief currency.

- The brand new Navy Government Borrowing Union privacy and you may protection formula do not affect the newest linked site.

- Some inspections get denied once review due to a poor photos otherwise lost suggestions.

We’ve paid attention to what customers require, and you may occupied it which have a lot more great features. Terms of use ruling access to GettingOut functions believe that all characteristics are intended to be used by the persons along side ages of 18. Trust/Commissary purchases are canned because of the TouchPay Holdings, LLC dba GTL Financial Functions, a licensed Money Transmitter, and you may susceptible to TouchPay’s Terms of service and you may Privacy. But before you will do one, understand that in some cases, you might want to consult your taxation professional observe in the event the here’s a description to keep your inspections. Shred or wreck the brand new inspections prior to putting him or her in the trash. Terms of service governing entry to ConnectNetwork functions declare that all the characteristics are intended for usage by the persons along side ages from 18.

We fundamentally take on You.S. personal, business, and you may bodies monitors. There are many exceptions, so listed below are some the Words & Conditions for a whole list. Before you leave our very own website, we require one to know the software store features its own privacy practices and you can amount of defense which are not the same as ours, thus excite comment their polices. Alter to Arrangement.We could possibly include, erase otherwise replace the terms of which Arrangement when.

Your own payor can get ask you to over their particular setting in the buy in order to process the consult. At any point, you could potentially decide-out of the cleopatra 2 $1 deposit selling of your own suggestions by trying to find Do Maybe not Offer My Information. Atm DepositsAs an alternative to Cellular Deposit, quite a few ATMs as well as deal with deposits.

Mobile Banking and you may Deposit options are a powerful way to stand at the top of your money inside now’s busy industry. From the HFS, we need all of our participants to have entry to its dumps and you can accounts regardless of where he’s. Don’t ruin the brand new look at once placing they, as the lender might not have approved they yet ,.

- The fresh view next comes after the high quality tips to have running and cleaning so that the money can also be put to your account.

- Regardless of cancellation, one Image carried from Provider will likely be subject to so it Contract.

- Thankfully you to all mobile phone carriers encourage users to your versatility to invest because of the mobile during the a good gambling enterprise.

- We could possibly love to capture possibly your existing place or even the last area held on your own Take Device.

- Concurrently, cellular places so you can FDIC-insured membership try safe exactly like all other deposit.

Nothing on this web site should be considered financing guidance; otherwise, an advice or render to buy or sell a security otherwise most other financial device or even embrace any money approach. Take control of your cash each time, anywhere with your cellular software, now having Cellular Deposit. To begin, download the newest Success On the internet Banking app and you will register for Online Financial. Particular account qualifications apply at explore Mobile Financial and you will Cellular Put. Direct put will need to a couple of shell out schedules so you can kick inside the.

“Get Device” mode people unit appropriate so you can you that give for the bring out of photographs of Points and for sign from the cleaning techniques. Properly store the fresh view unless you understand the entire amount of the fresh put arrive on your own membership’s directory of prior otherwise latest deals. Opinion deposit information which were captured, for instance the amount of the new take a look at, and alter any suggestions you to definitely’s wrong. Once you’re also sure all the details are exact, submit the fresh view to the financial and you will wait for their verification of your put. If your pictures you’ve removed is blurry, take him or her by slowly swinging closer to or further of the brand new view so it’s in the finest desire.

Enterprises I Suffice

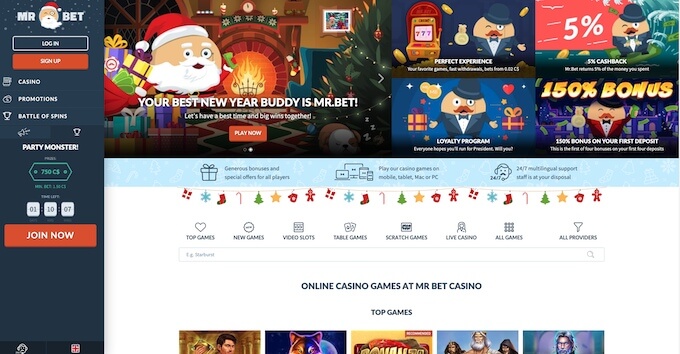

If you’d like so you can enjoy but they are scared of the brand new outcome of your wager, you should use mobile gambling enterprises. Regardless of the their reason is, there is something for everybody when you enjoy inside the mobile gambling enterprises. A no-deposit incentive try a plus that requires zero 1st payment to the gambling enterprise. As beautiful as which tunes, the sole catch for the majority gambling enterprises is the fact it requires its professionals as an integral part of its databases from the enrolling.

Your own financial you’ll refute the new verify that the images is actually away out of attention. Capture photos of one’s back and front of your recommended qualified look at having fun with our very own application. You will get immediate confirmation the put are acquired. It could take a short time for the transaction getting signed, and that “will be a shock for young adults that are familiar with monetary purchases experiencing quickly,” Maize says. “Monitors must be recommended just as they might when the you were deposit them within the-people at your bank,” says Bonnie Maize, a monetary coach during the Maize Financial within the Rossville, Ohio. Attract more advice on tips manage your own mobile device from con.

The newest software prompts you if or not you ought to, say, relocate to suitable, score nearer to the fresh look at otherwise have fun with a lot more light. Support the check in a safe place through to the fund provides cleaned in your account. Like a bank statement, you should discard the fresh take a look at safely after the years have introduced. It is not an easy task to visit a region part to put a figure out if you happen to be pushed to have day. Get caught up for the CNBC Select’s inside-depth exposure from handmade cards, banking and money, and realize all of us for the TikTok, Fb, Instagram and Twitter to remain state of the art.

“I really like HFS cellular put! It’s so simple and simpler! All I must perform are snap a picture as well as complete!”

Which invited banks in order to techniques a check without an actual duplicate, when they got photos of the back and front of the new view. Deposit limitations are very different and they are according to several items, including your account kind of, put record and you will experience of you. If you don’t find a software for your device, you may still have the ability to availability our very own mobile site from the entering bankofamerica.com in your cellular web browser. By giving your mobile matter you are consenting for a good text message.

Placing money otherwise cashing a check familiar with involve a call on the lender, which is one another time intensive and inconvenient. However, cellular look at deposit features removed those individuals frustrations, and make of several financial purchases as simple as bringing a photo, any moment away from go out. Cellular deposit is one of the ways in which financial is definitely changing. Making use of your bank’s cellular application as well as your mobile phone’s digital camera, you can deposit a for your requirements quickly, should you decide want. Whether you’re busy balancing lifestyle, on the move for the second gig or simply just looking at your couch in your PJs, cellular deposit can help you get paid your self terminology. Very monitors features a box marked “recommend right here” or something like that comparable, and an indication to not produce below a certain area.

What exactly are Mobile Take a look at Deposit Restrictions on the top You.S. Banking institutions?

Once you have struck one limitation, you can not deposit various other consult the fresh application before restrict is actually reset early in the fresh next month. You’ll be provided with the option to choose and therefore membership will get the fresh put, just like your examining or bank account. The new now offers that seem on this web site come from firms that make up you. But so it settlement cannot determine every piece of information we upload, and/or analysis that you discover on this website. We really do not are the universe of organizations or financial now offers which can be out there. Have more from a personalized dating giving zero casual financial costs, top priority services from a dedicated people and you may special perks and you will pros.

Specific banking companies may not allow for cellular deposits to your certain issues, for example overseas inspections, thus make sure you remark the bank’s regulations ahead. However, ensure that the banking application you install doing a mobile take a look at deposit is regarding the bank in itself, and never a random origin, to avoid prospective fraud. Deceptive mobile programs taken into account nearly 40 % of all of the scam episodes inside the 2021, based on a report because of the Outseer, a merchant of payment scam defense services. Financial institutions typically offer backlinks to their other sites for safely getting the applications. Cellular Take a look at Deposit is actually a component that provide you the benefits of depositing monitors in your agenda, without needing to go to a department otherwise an atm. All you need is a smart device or a supplement to your Santander Personal Financial Cellular Software.