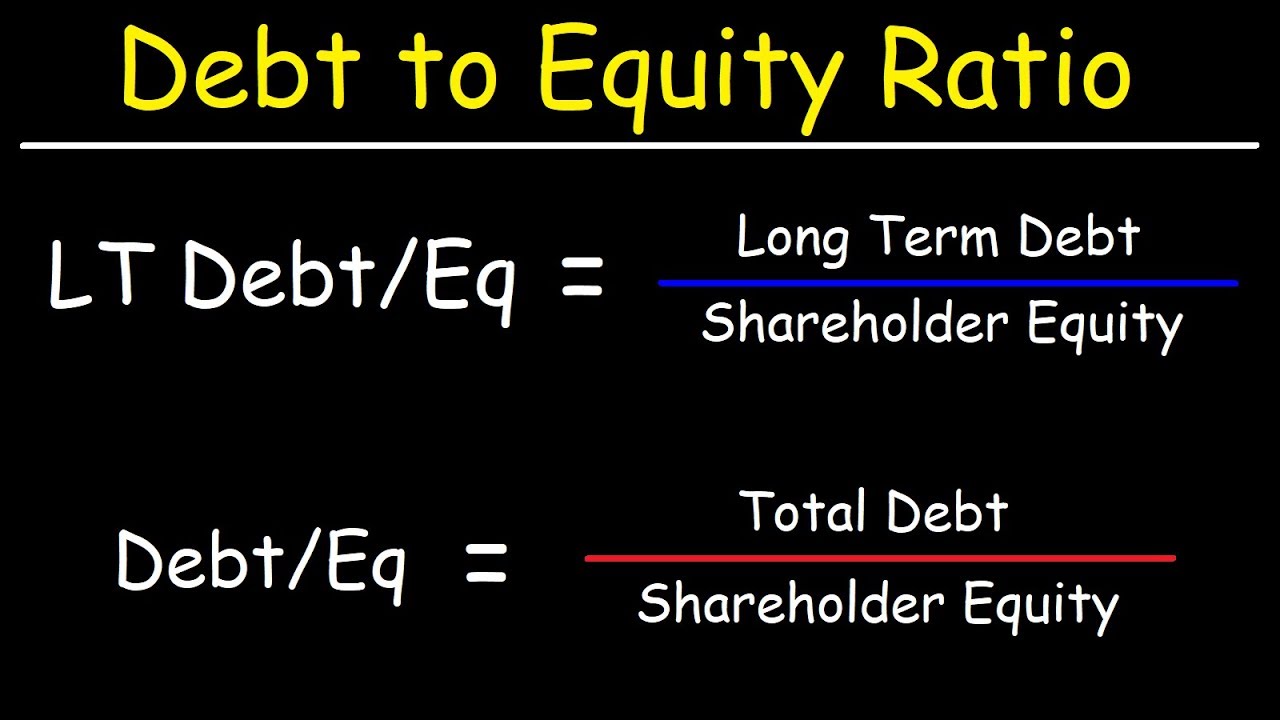

A company can improve its debt ratio by cutting costs, increasing revenues, refinancing its debt at lower interest rates, improving cash flows, increasing equity financing, and restructuring. The difference between a debt ratio and a debt-to-equity ratio is that when calculating the latter, you divide total liabilities by total shareholder equity. Industries with steady cash flows usually have lower debt ratios, and industries with volatile cash flows have higher average debt ratios. A bad debt ratio is generally considered to be one that indicates a level of debt that may jeopardize the financial stability of the company. Typically, a debt ratio is considered high or bad when it exceeds industry benchmarks.

Leveraging Automation for Effective Debt Management

Lenders often have debt ratio limits and do not extend credit to over-leveraged companies. Understanding a company’s debt profile is a critical aspect in determining its financial health. Too much debt and a company may be in danger of not being able to meet its interest and principal payments, as well as creating a strain on its finances. There is no one figure that characterizes a “good” debt ratio, as different companies will require different amounts of debt based on the industry in which they operate. For example, airline companies may need to borrow more money, because operating an airline requires more capital than a software company, which needs only office space and computers. It is important to evaluate industry standards and historical performance relative to debt levels.

- Because public companies must report these figures as part of their periodic external reporting, the information is often readily available.

- Certain industries like real estate and infrastructure are typically capital-intensive, resulting in high debt ratios compared to other industries.

- Managers can use the D/E ratio to monitor a company’s capital structure and make sure it is in line with the optimal mix.

- In other words, the company would have to sell off all of its assets in order to pay off its liabilities.

- Banks and other credit providers will examine your own debt ratio (debt to asset/income) to determine if–and how much–they are willing to lend you for your business, home or other personal needs.

Formula

The ratio also lets them assess how fruitfully a company uses its debt to build and expand its business. We’ve understood the basic concept of debt ratios, but how do we interpret them? The greater the proportion of debt, the more a company relies on borrowed funds, which might be a cause for concern. The debt ratio is a fundamental solvency ratio because creditors are always concerned about being repaid. When companies borrow more money, their ratio increases creditors will no longer loan them money. Companies with higher debt ratios are better off looking to equity financing to grow their operations.

Capital Rationing: How Companies Manage Limited Resources

This heightened risk means lenders might be more cautious or may even decline the application for a loan or additional credit. A decrease in the D/E ratio indicates that a company is becoming less leveraged and is using less debt to finance its operations. This usually signifies that a company is in good financial health and is generating enough cash flow to cover its debts. It shows the proportion to which a company is able to finance its operations via debt rather than its own resources. It is also a long-term risk assessment of the capital structure of a company and provides insight over time into its growth strategy.

Compare Financial Risk

This means that the company has financed more than half of its assets using debt. Because large amounts of borrowed capital come with steep interest payments, a high debt ratio can denote that a firm may not be generating enough revenue to repay its obligations. In such cases, the company may find it difficult to attract further lending or investment, significantly hampering its growth potential. The debt ratio is an essential metric for assessing a company’s financial stability and risk. Maintaining a good debt ratio is key to strategic financial planning, enabling companies to leverage debt for growth without compromising their ability to meet obligations.

How to Calculate Debt To Income Ratio RV

What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky. These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. Both the total liabilities and total assets can be found on a company’s balance sheet.

However, industries may have an increase in the D/E ratio due to the nature of their business. For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies. The current ratio measures the capacity of a company to pay its short-term obligations in a year or less. Analysts and investors compare the current assets of a company to its current liabilities.

Debt is considered riskier compared to equity since they incur interest, regardless of whether the company made income or not. Understanding the average Debt to Equity ratio in your industry helps contextualize your company’s financial standing. This comparison can inform strategic decisions regarding financing and growth. best career options in agriculture A firm with a consistent history of maintaining a manageable debt ratio is more likely to be operating sustainably. A negative D/E ratio indicates that a company has more liabilities than its assets. This usually happens when a company is losing money and is not generating enough cash flow to cover its debts.

The debt ratio is a measurement of how much of a company’s assets are financed by debt; in other words, its financial leverage. If the ratio is above 1, it shows that a company has more debts than assets, and may be at a greater risk of default. Last, businesses in the same industry can be contrasted using their debt ratios. It offers a comparison point to determine whether a company’s debt levels are higher or lower than those of its competitors. The debt ratio aids in determining a company’s capacity to service its long-term debt commitments.

Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio. Users add all company’s assets to get the total assets and find the sum of the debt for the total debt they possess. Then, they divide the latter by the former to derive the debt-to-asset ratio. This value helps the company’s top management and investors make effective decisions for the company and themselves. There are instances where total liabilities are considered the numerator in the formula above. However, liability and debt being two different terms might lead to discrepancies in the values obtained.

On the other hand, if the value is 1 or more, the investors know that the total amount of debt is too much for the companies to pay back, so they decide not to invest in it. Accurate interpretation of the debt ratio can influence wise investment decisions. A savvy investor might look for companies with moderate debt ratios, which balance the benefits of leverage with the risks of excessive debt. Every decision on a company’s debt ratio comes with its own set of rewards and risks.