Understanding which stock is available at a given time requires constant updates or a perpetual system. Table6.1 There are severaldifferences in account recognition between the perpetual andperiodic inventory systems. When searching for your perpetual inventory software, keep an eye out for features your business operations needs and would benefit from most. This could include automated stock updates or an extensive list of integrations to connect with your other business systems. Moreover, cloud-based systems offer scalability that isn’t available from traditional systems.

How frequently does a physical inventory need to be taken with a perpetual inventory system?

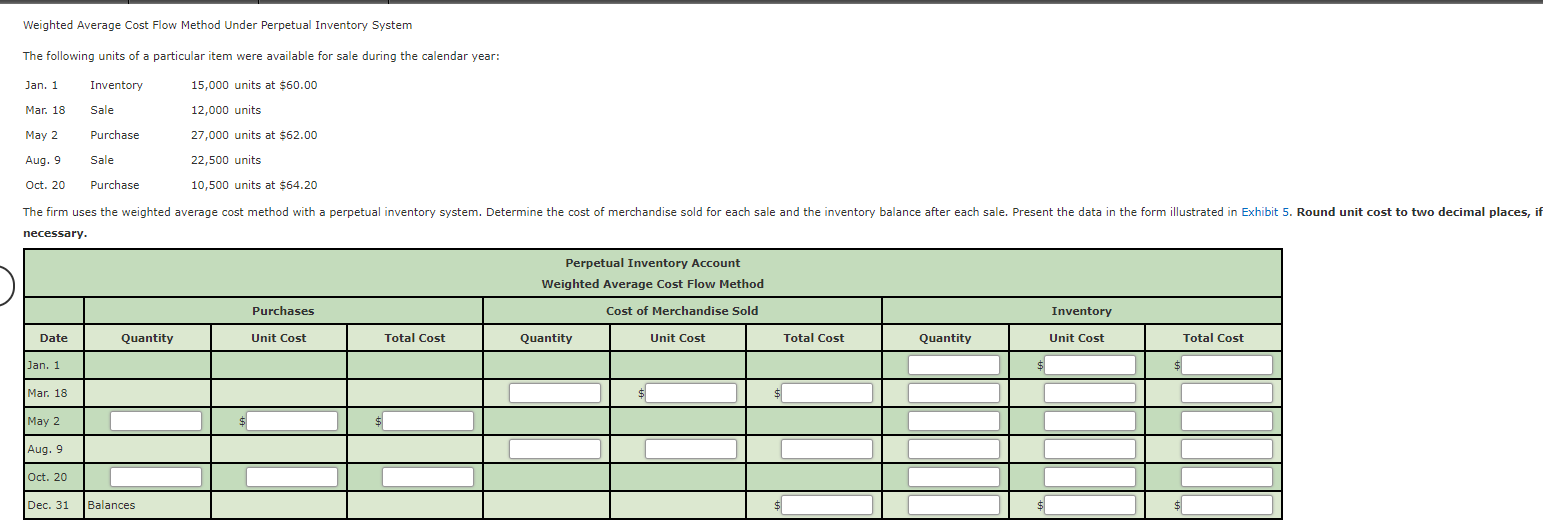

Not only does it help track inventory data in real-time, but it also helps eliminate labor costs and human error. Let’s look at why ecommerce businesses choose to use a perpetual inventory system. The goal of using the WAC is to give every inventory item a standard average price when you make a sale or purchase.

- It can be done by using this data to gain a deeper understanding of any process bottlenecks.

- The last in, first out (LIFO) method means you sell your newest purchased or manufactured goods first.

- It also isn’t as up to date as a perpetual system, as it is done at periodic intervals rather than continuously.

- It could be when creating financial statements or if the stock was destroyed.

Accurate Financial Information

Let’s say Ava, a product manager, wants to know if she is pricing generic Acetaminophen high enough to leave a healthy profit margin. If she calculates the COGS as $10 per 100-capsule bottle, she will need to price each bottle higher than $10 so her company can comfortably turn a profit. Inventory management formulas can tell you when to order more inventory, how much to order, the lead time needed before placing an order and how much stock you require to keep in safety. Therefore, the company should order approximately 447 units at a time to minimize the total ordering and holding costs. When inventory arrives in your warehouse, the goods are received and immediately scanned into your inventory.

What is your current financial priority?

The information collected digitally is sent to central databases in real time. Businesses increasingly track inventory using a perpetual inventory system versus the older, physical-count periodic inventory system. Perpetual systems are costly to implement but less expensive and time-consuming over the long haul. The first in, first out (FIFO) method assumes that the oldest units are sold first, while the last in, first out (LIFO) method records the newest units as those sold first. Businesses can simplify the inventory costing process by using a weighted average cost, or the total inventory cost divided by the number of units in inventory. Proponents of perpetual inventory systems don’t always go out of their way to point out the downsides of these systems, the chief of which is the lack of accounting for loss, breakage, or theft.

Calculates end-of-year inventory balance

The perpetual inventory system involves the continuous updating of inventory records. These updates include sales and purchases through computerized point-of-sale systems and enterprise asset management software. While perpetual inventory systems offer rich information for management, maintaining these systems is costly and time-consuming, unless the firm has completely computerized its inventory control system. The nature and type of business you have will factor into the kind of inventory you use.

A perpetual inventory system requires software to continuously track thousands of records in real-time. But, you could manually track transactions in a periodic inventory system, as it only needs updating every period. The LIFO (last-in, first-out) perpetual inventory method is the opposite of FIFO and makes a cost flow assumption that the last items received in inventory are the first items sold. So, the inventory remaining at the end of the period is the oldest purchased or produced. The FIFO (first-in, first-out) perpetual inventory method makes a cost flow assumption that the first items received in inventory are the first items sold.

Accountants don’t have to constantly adjust the changes in inventory levels since everything is done by the computing system (for the most part). For example, optical scanners are used in markets to keep track of inventory quantities, but at the end of the accounting period, a physical inventory is performed. However, even with such sophisticated equipment, perpetual records may be kept only in units, with the cost of ending inventories and goods sold determined by the periodic inventory system. Recently, computing systems and other input devices, networking technologies, and Internet-based applications have taken over and made perpetual inventory systems less burdensome for employees.

Under this system, no purchases account is maintained because inventory account is directly debited with each purchase of merchandise. where’s my refund how to track your tax refund status, the expenses that are incurred to obtain merchandise inventory are added to the cost of merchandise available for sale. These expenses are, therefore, also debited to inventory account under this system.

This formula reflects the costs of storing your inventory in addition to the actual cost of the goods. Economic order quantity dictates the optimal inventory levels you need to minimise expenses. These formulas calculate your gross capital inventory at the end of an accounting period. Assuming straight-line depreciation, for allocating the cost of your inventory asset the depletion of fixed capital can be calculated using a formula.

Perpetual inventory is computerized, using point-of-sale and enterprise asset management systems, while periodic inventory involves a physical count at various periods of time. The latter is more cost-efficient, while the former takes more time and money to execute. Because perpetual inventory systems lack the ability to account for loss, breakage, or theft, a periodic (physical) inventory can still be necessary. With access to accurate and up-to-date inventory data, businesses can make more informed decisions about demand forecasting and inventory planning. Real-time data helps identify sales trends, seasonal demand, and product performance, allowing businesses to adjust their inventory strategy accordingly.